Ocugen is a small biotech company based outside Philadelphia with 15 employees. The company was founded in 2013 by the current CEO, Dr. Shankar Musunuri, whose experience is primarily in vaccine development, and Dr. Uday Kompella, a Pharmacy professor at the University of Colorado, to develop therapies for eye disesases. Ocugen became a public company in April 2019 through a reverse-merger with Histogenics [HSGX], an ill-fated regenerative medicine company. (recall Buyersstrike's Maxim #1).

Ocugen has struggled to raise capital, attract experienced biotech investors, or make any clinical progress since its founding. The 2016 Series A was conducted through an EB-5 immigration scheme, and the company raised $7.5M in 2017 in a Series B led by a Turkish drug company and a conglomerate from Kazakhstan. Very Nice! In 2020, Ocugen's most advanced program, a novel "nanoemulsion" formulation of brimonidine, failed in Phase 3. Nevertheless, the company persisted, continuing work on three programs: gene therapies for retinal degeneration and Dry AMD, and a biologic, a tumstatin-tranferrin fusion intended to have an anti-angiogenic function for diabetic macular edema, diabetic retinopathy, and Wet AMD. None of these programs have reached the clinic, although Ocugen has announced that it plans to file INDs this year. Through most of 2020, the stock traded under fifty cents, with a market cap of under $60M, and was at risk of being delisted from NASDAQ.On December 22, 2020, Ocugen announced a letter of intent to work with Bharat Biotech, an Indian vaccine maker, to co-develop COVAXIN for the US market [COVAXIN LOI press release]. COVAXIN is an inactivated, whole-virion vaccine that uses an alum-imidazole adjuvant (from ViroVax). The inactivated vaccine strategy involves growing live virus in Vero (monkey) cells, and then treating the virus with beta-propriolactone, which reacts with the nucleic acids, rendering the virus inactive and unable to replicate. This is well-established technology used for many decades to produce polio and rabies vaccines, as well as newer vaccines such as one for Japanese Encephalitis.

Following the announcement, Ocugen shares ran from $0.29 to around $2.00 by Christmas. After finalizing the deal (which has terrible economics, giving Ocugen only 45% of profits and all of the development risk) in February, the stock popped briefly to over $18.00, before settling around $8 to $10, giving Ocugen a market cap of nearly two billion dollars.

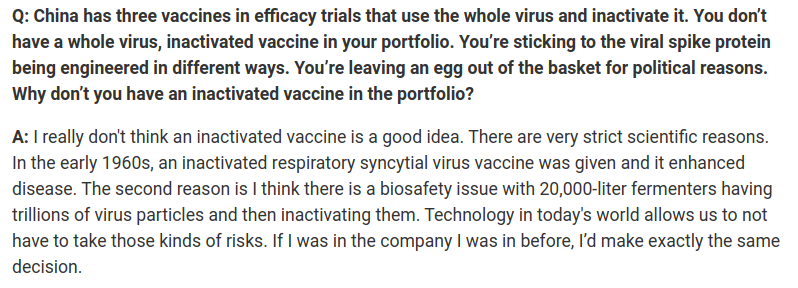

An inactivated vaccine does have some interesting characteristics and hypothetical advantages. The approach is established and easy to understand, and many inactivated vaccines on the market are considered to be very safe. A number of observers (including me!) were surprised that the US did not pursue this 'old-school' inactivated approach last year, at least as a backup plan, and many were also initially skeptical of mRNA vaccines, which had never before been deployed.

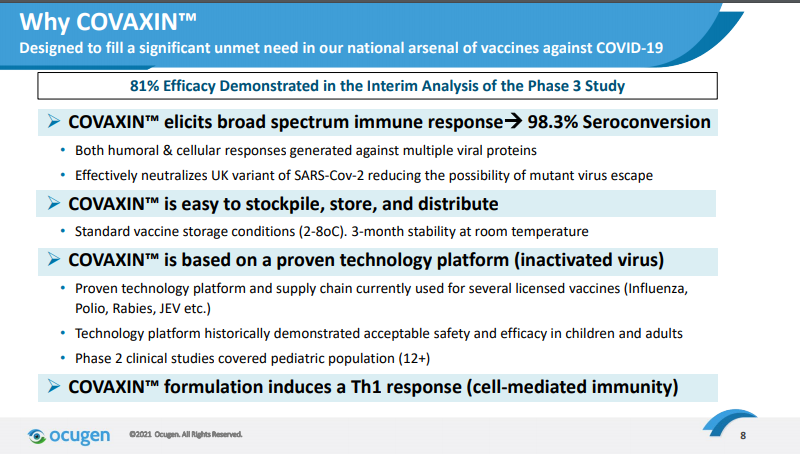

In their most recent corporate presentation, Ocugen claims that COVAXIN is "Designed to fill a significant unmet need in our national arsenal of vaccines against COVID-19." Specifically, they point to the first set of interim Phase 3 results from India, which demonstrated "81% efficacy". This appears to be on par with the adenovirus-based vaccines from J&J and AZ, but less effective than the mRNA vaccines. The vaccine requires only normal refrigeration (similar to the adenovirus vaccines) and is distributed in multi-dose vials with 2-phenoxyethanol as a preservative, enabling a 28-day shelf life even once opened. This may be an especially useful property in India, but less relevant in the US. Ocugen mentions that Covaxin elicits a Th1 cell-mediated response in addition to antibodies -- but so do all of the other COVID vaccines already available.

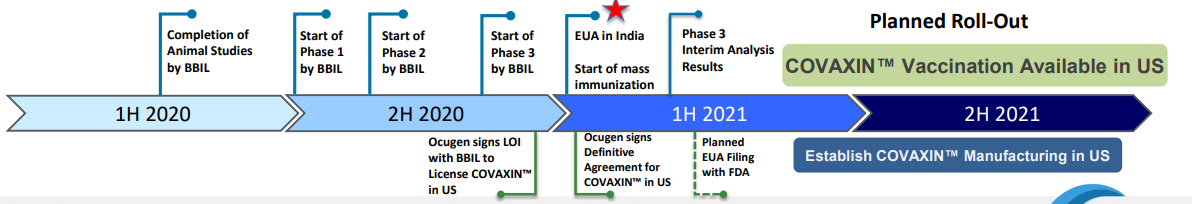

Ocugen has outlined an ambitious set of planned milesones for their US development of Covaxin.

The Covaxin vaccine itself is probably safe and quite effective, and is a boon to public health in India and globally. However, Covaxin development has already been controversial. The vaccine was rushed into emergency use in India prior to the completion of Phase 3 trials. Luckily, Covaxin seems to be safe, and interim results from a large Phase 3 trial show that it is indeed effective, according to Bharat's press release.

Bharat and Ocugen have touted preclinical studies showing that the vaccine results in neutralizing antibodies against the UK variant (as do most of the other vaccines), although data for some of the more concerning variants (eg. B.1.351) has not yet been disclosed. The Phase 3 results have not yet been published, so the study is impossible to evaluate in detail, but so far, based on the studies and concurrent widespread emergency use in India, COVAXIN appears to be a safe vaccine with adequate efficacy. Covaxin is a two-dose vaccine, which puts it at a disadvantage to the one-shot J&J adenovirus based vaccine, which has comparable efficacy and relaxed storage requirements.

Importation and distribution of Covaxin manufactured in India would require FDA inspection of manufacturing facilities.

The initial Ocugen plan requires importing COVAXIN manufactured by Bharat in India. However, the FDA is not going to take any chances or short-cuts, especially now that three safe, effective vaccines are available under EUA, with two more likely to be authorized soon. The mere idea of permitting US distribution of a controversial vaccine from India would be deeply counterproductive towards efforts to assure the public of vaccine safety and reduce vaccine hesitancy. Whether or not it is fair to Bharat, the potential risk to US public health messaging would be unacceptable.

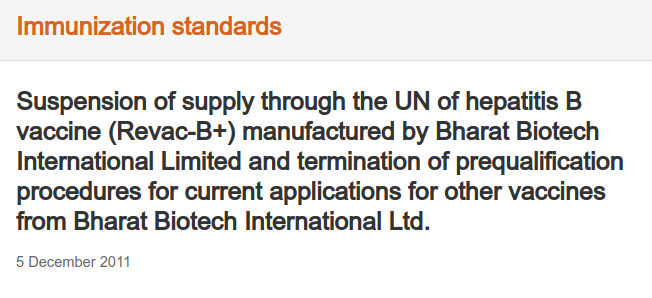

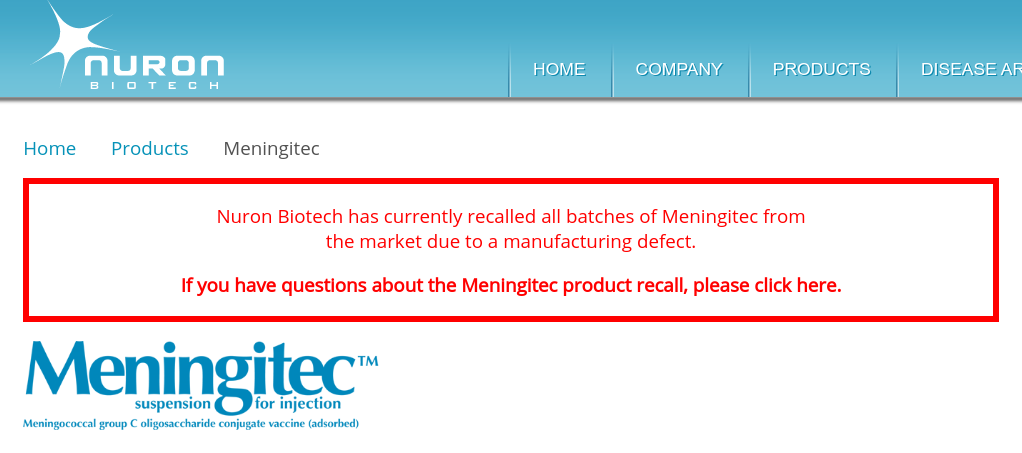

Indian drug manufacturing in general has a very spotty track record of quality and safety, as recently documented in Bottle of Lies, the excellent book by Katharine Eban. Bharat Biotech specifically has had serious QA and regulatory issues in the past when subjected to international scrutiny. In 2011, the WHO suspended use of Bharat Vaccines and terminated their prequalifiaction for all Bharat vaccines after finding deficiencies in implementation of good manufacturing practices. While Bharat eventually resolved these issues and continues to sell millions of doses of important vaccines to the developing world, this incident highlights the importance of inspections and will contribute to setting the priors of the FDA when considering manufacturing risks. I believe that the FDA will absolutely be unwilling to authorize or approve any vaccine without significant on-site inspections and validation.

There are currently zero vaccines approved in the United States that are manufactured in India [https://www.fda.gov/vaccines-blood-biologics/vaccines/vaccines-licensed-use-united-states]. Moreover, CBER, the division of the FDA that regulates vaccines, has never inspected any vaccine manufacturing sites in India (at least as far back as records are available). The handful of CBER inspections in India appear to have been of individual physician clinical sites. Sending a team to inspect Bharat manufacturing is unlikely to be feasible in the near term, and is not going to be a priority for the FDA, who remain extremely busy.

Covaxin trials have not been conducted under an FDA IND, which will cause complication, delay, and increased scrutiny. The FDA has even been reluctant to even consider an EUA application from AstraZeneca until their US trials were completed. With plenty of vaccine soon available, the US is no longer in an emergency, and the FDA will never authorize a vaccine based solely on non-IND trials in India (let alone for the 12-and-up pediatric indication that Ocugen touts).

Not only are the Indian trials going to be unacceptable to the FDA, but doing US trials will be nearly impossible. Other vaccine manufacturers are already running pediatric trials in the US. Ocugen may have difficulty even filing an IND to run trials for vaccine manufactured by Bharat in India, and might have to first set up US manufacturing, at risk. Even worse, by the time that Ocugen might be ready to do any US trial, it will be unethical to conduct a trial comparing against a placebo control. Ocugen would have to demonstrate equivalence or superiority to mRNA vaccines which we already know are likely to have superior efficacy.

Even if COVAXIN was to be miraculously authorized by the FDA, nobody would buy it. The only buyer of COVID vaccines is currently the US Government, which has already ordered more than enough vaccine to meet US needs. In the longer term, to deal with variants, other platforms are superior: mRNA-based vaccines can be very rapidly updated without changes to manufacturing processes, and recombinant protein platforms (Novavax) are well suited to polyvalent vaccines. There is no current evidence that immunity resulting from inactivated vaccines is clinically superior to the results already being achieved with these more flexible strategies.

Regardless of COVAXIN safety and efficacy, US consumers will be skeptical. In an environment where government and public health agencies are already dealing with troubling levels of vaccine hesitancy, authorities at every level will be reluctant to introduce yet another controversy and risk. Moreover, any concerns (real or imaginary) about safety will be amplified when considering vaccination of children, the market for which Ocugen makes the absurd claim that COVAXIN would have a safety advantage.

As discussed above, the Federal government will be relucant to alter their approach to vaccines without reason. It would optically and politically unattractive to purchase vaccine from India or even to imply that such a vaccine is needed. It would also be ridiculous for India to export vaccines to the US when these doses are still desperately needed within India and elsewhere in the world.

Even if the US ever did change their minds, they would likely work with Valneva, the only Western company that has been developing an inactivated COVID vaccine, VLA2001. Valneva is using a proprietary adjuvant, CpG 1018, licensed from Dynavax, and is manufactured on an established plaform that Valneva uses for manufacturing their FDA-approved Japanese Encephalitis vaccine, which is sold to the US Military. The CpG 1018 adjuvant is also already used in an FDA-approved vaccine sold by Dynavax, HEPLISAV-B. Valneva has a contract to sell 100M doses of VLA2001 to the UK, pending their regulatory approval, with an option for an additional 90M doses. Valneva already has a close working relationship with the US governent and BARDA, and their BSL-3 factories in Scotland are already inspected by FDA. Still, significant US acquisition of an inactivated vaccine remains unlikely, given what is now known. Stockpiling an inactivated vaccine of a particular strain is no longer an optimal strategy; rather, investments are being made in scaling up capacities for rapid development and manufacturing of mRNA and recombinant vaccines for the next threat

It is possible that OCGN could triple on its way back to a dollar or two. The most likely time that this could happen is on the announcement of further interim and then final results from the India trial, which will spark a fresh round of press releases and interviews. I would relish the opportunity to short more OCGN stock at $15, $20, or higher. However, with the good news about COVAXIN efficacy already out, and the demonstrable poor communication and messaging abilities of management, the cracks in the facade are already starting to appear.